Is It Really Good to Have Insurance?

When you hear the word insurance, what’s the first thing that comes to mind? For some, it’s peace of mind. For others, it feels like just another monthly expense. With so many different types of insurance out there—health, car, life, home—it’s no wonder people stop and ask themselves: Is it really good to have insurance? The truth isn’t black and white. It depends on your lifestyle, financial situation, and how you weigh risk against reward. Let’s break it down in simple terms.

Understanding What Insurance Actually Means

At its core, insurance is a safety net. You pay a set premium—monthly, quarterly, or yearly—and in return, the insurance company promises to cover certain expenses if unexpected events happen.

For example:

- Health insurance helps cover medical bills when you’re sick or injured.

- Car insurance pays for damages after accidents.

- Life insurance provides financial support to your loved ones if something happens to you.

- Home or renters’ insurance protects your property from theft, fire, or natural disasters.

The big idea? Instead of you shouldering the entire financial burden, insurance spreads that risk across many people.

The Benefits of Having Insurance

Insurance often feels unnecessary until life throws a curveball. Here’s where it shines:

- Financial protection: Instead of draining your savings after a hospital stay or car crash, insurance cushions the blow.

- Peace of mind: You can sleep easier knowing you’re covered in emergencies.

- Access to better services: Health insurance often gives you access to better healthcare networks.

- Legal requirements: Car insurance is mandatory in most states. Having it isn’t just good—it’s the law.

Without insurance, one major accident or illness could set you back thousands—or even bankrupt you.

The Flip Side: Downsides of Insurance

Let’s be real—insurance isn’t perfect. Many people hesitate because of:

- High premiums: Monthly payments can add up, especially if you’re juggling multiple policies.

- Complex terms: Policies are often full of jargon that’s hard to understand.

- Coverage gaps: Sometimes, what you think is covered actually isn’t.

- Unused premiums: If you never file a claim, you may feel like you’re paying for “nothing.”

That’s why it’s important to weigh the cost versus the protection you’re getting.

Is Insurance Worth the Cost?

Think of insurance like an umbrella. You don’t always need it, but when the storm hits, you’re glad you have it.

- If you’re young and healthy, health insurance may feel like an unnecessary expense, but one ER visit could wipe out your savings.

- If you own a car, skipping car insurance isn’t an option—it’s legally required and protects you from lawsuits.

- If you have dependents, life insurance ensures they’re financially secure if you’re not around.

- If you rent or own property, insurance protects your belongings from fire, theft, or natural disasters.

So yes, it’s an ongoing expense, but it’s also a shield against financial disaster.

Common Types of Insurance Everyone Should Consider

Here’s a quick rundown of insurance types that provide real value:

- Health Insurance: Covers doctor visits, prescriptions, and hospital stays.

- Car Insurance: Protects you and others on the road.

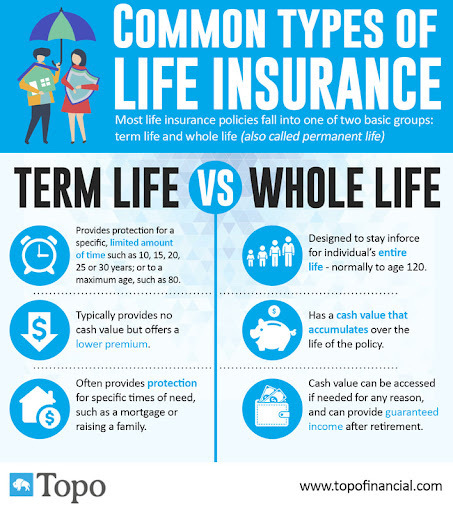

- Life Insurance: Secures your family’s financial future.

- Home/Renters’ Insurance: Covers property damage or theft.

- Travel Insurance: Useful for covering medical emergencies, lost luggage, or trip cancellations abroad.

Not everyone needs every type, but most people benefit from at least two or three.

Quick Comparison: Insurance Pros and Cons

Here’s a simple table that sums it up:

| Type of Insurance | Pros (Why It’s Good) | Cons (Why People Avoid It) |

|---|---|---|

| Health Insurance | Covers expensive medical bills, access to better care | High premiums, deductibles |

| Car Insurance | Legal requirement, protects against accidents and lawsuits | Premiums rise after claims |

| Life Insurance | Provides security for family, long-term financial planning | Can feel unnecessary for singles |

| Home/Renters Insurance | Protects property from fire, theft, disasters | Coverage limits, exclusions |

| Travel Insurance | Covers emergencies abroad, peace of mind while traveling | May not always be needed |

This table shows that while every policy has drawbacks, the advantages often outweigh the risks.

How to Decide If Insurance Is Good for You

Not sure if you need insurance? Here are some guiding questions:

- Do you have enough savings to cover emergencies?

- Do you own valuable assets like a car or home?

- Do you have family members who depend on your income?

- Would a sudden accident or illness leave you in debt?

If your answer is “yes” to most of these, then insurance isn’t just good—it’s necessary.

Smart Tips to Get the Most Out of Insurance

If you’re going to spend money on insurance, make sure you do it wisely:

- Compare policies: Don’t settle for the first plan. Use online comparison tools.

- Check coverage limits: Understand what’s included and what’s excluded.

- Bundle policies: Many companies offer discounts if you combine car + home insurance.

- Review yearly: Your needs change, and so should your coverage.

- Ask about discounts: Safe drivers, non-smokers, and even good students often qualify.

A little homework can save you hundreds—or even thousands—in premiums.

Final Thoughts: Is Insurance Really Good to Have?

So, is it really good to have insurance? The short answer: Yes—most of the time.

Insurance isn’t just about paying bills; it’s about protecting your future. Sure, it can feel like a drain on your wallet, and yes, sometimes you’ll pay for coverage you never use. But when life takes an unexpected turn, that “unused” coverage suddenly becomes priceless.

In the end, insurance is less about “if” you’ll need it and more about when. And when that time comes, you’ll be thankful you made the smart choice to be covered.