Cheapest Full Coverage Car Insurance in California

Finding the cheapest full coverage car insurance in California can feel like searching for a needle in a haystack. With so many insurance companies competing for attention, each promising low rates and great coverage, it’s easy to get lost in the noise. But here’s the truth: the cheapest option for one driver might not be the same for another. Why? Because insurers look at dozens of factors—like your driving history, age, zip code, and even your credit (though California limits how insurers use credit)—before setting your rate.

So, how do you cut through the clutter and actually find the best deal? Let’s walk through everything you need to know about full coverage auto insurance in California, how much it costs, what factors impact your rates, and which companies consistently show up at the top of the affordability list.

What Does Full Coverage Car Insurance Mean in California?

“Full coverage” doesn’t mean you’re covered for absolutely everything—it’s just a common way of saying you carry more than the state minimum liability insurance. In California, the minimum coverage requirements are:

- $15,000 for bodily injury liability per person

- $30,000 for bodily injury liability per accident

- $5,000 for property damage liability

But if you stop there, you’re financially exposed. Full coverage typically includes:

- Liability insurance (required by law)

- Collision coverage (covers repairs if your car hits another vehicle or object)

- Comprehensive coverage (covers theft, vandalism, weather, animal collisions, etc.)

- Uninsured/Underinsured motorist protection (very useful in California, where many drivers don’t carry enough insurance)

Basically, full coverage gives you peace of mind, especially if you have a newer or financed car.

Average Cost of Full Coverage Car Insurance in California

On average, Californians pay around $2,200–$2,800 per year for full coverage car insurance, which breaks down to about $180–$230 per month. However, the actual price can swing dramatically based on your situation.

For instance:

- A 25-year-old with a clean record might pay $160/month.

- A 40-year-old safe driver in Los Angeles might pay $210/month.

- A driver with an accident or DUI history could see rates jump to $350+/month.

Compared to the national average of about $2,000/year, California tends to be slightly more expensive, largely due to high traffic density, repair costs, and accident frequency.

Factors That Impact the Cheapest Full Coverage Car Insurance in California

When insurance companies set your premium, they weigh a variety of risk factors. Here’s what matters most in California:

- Driving record: Accidents, speeding tickets, or DUIs can spike your rates.

- Age and experience: Younger drivers usually pay more due to lack of experience.

- Location: Living in Los Angeles, San Francisco, or Oakland often means higher premiums compared to smaller towns.

- Vehicle type: Luxury cars and sports cars cost more to insure than economy sedans.

- Coverage limits: Higher deductibles can lower your monthly payment.

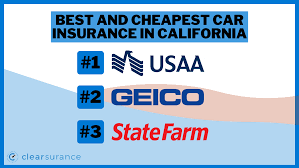

Cheapest Full Coverage Car Insurance Companies in California

Let’s get to the part you really want to know—who actually offers the cheapest full coverage car insurance in California? Based on multiple surveys and rate analyses, these companies consistently come out on top for affordability:

| Insurance Company | Average Monthly Cost (Full Coverage) | Best For |

|---|---|---|

| Geico | $165–$190 | Low rates for most drivers |

| Progressive | $170–$210 | Drivers who want flexible discounts |

| State Farm | $160–$185 | Safe drivers and bundling with home |

| Mercury Insurance | $175–$220 | California-focused insurer with good options |

| AAA | $180–$230 | Drivers who want roadside perks |

| Allstate | $190–$240 | Good for new cars, accident forgiveness |

While State Farm and Geico usually rank among the cheapest, Mercury Insurance (a California-based company) is often overlooked but provides competitive rates and strong local customer service.

How to Find the Cheapest Full Coverage Car Insurance in California

Getting the lowest rate isn’t just about picking the “right” company—it’s about how you shop. Here are a few smart strategies:

- Compare quotes online: Don’t settle for the first quote. Use comparison sites or request quotes from at least 3–5 companies.

- Bundle policies: If you own a home or rent, bundling with auto insurance can save you 10–20%.

- Adjust deductibles: Raising your deductible from $500 to $1,000 can cut your premium.

- Take advantage of discounts: Good student discounts, safe driver programs, low mileage discounts, and telematics (tracking driving habits) can all help.

- Keep a clean record: Even one accident can raise rates for years, so defensive driving really pays off.

Cheapest Full Coverage for Different Driver Profiles

Insurance isn’t one-size-fits-all. The cheapest company for a teenager won’t be the same for a 45-year-old. Here’s a breakdown:

- Young Drivers (18–25): Geico and State Farm tend to offer the lowest rates, especially for students with good grades.

- Middle-Aged Drivers (30–50): Mercury and Progressive often give the best deals.

- Senior Drivers (60+): AAA and State Farm are usually competitive.

- Drivers with Accidents/DUI: Progressive is often more forgiving, while Mercury sometimes beats larger carriers.

Is Minimum Coverage Ever Enough?

Technically, you can drive legally in California with only minimum liability coverage, but it’s a gamble. Imagine causing an accident that results in $50,000 in medical bills. With just the state minimum, you’d be on the hook for most of that out of pocket.

That’s why full coverage, while more expensive, is often the smarter financial move—especially if you rely heavily on your car or don’t have tens of thousands in savings to cover accident costs.

Final Thoughts on Getting the Cheapest Full Coverage Car Insurance in California

Finding the cheapest full coverage car insurance in California doesn’t have to be overwhelming. Yes, rates are higher than in many other states, but with smart shopping and the right discounts, you can trim hundreds off your annual bill.

The key is to compare multiple companies, consider your personal driver profile, and never sacrifice essential coverage just to save a few dollars. After all, insurance isn’t just a bill—it’s financial protection that keeps you from losing everything after an accident.

If you’re serious about saving, start with a quick comparison between State Farm, Geico, and Mercury, and then expand to others like Progressive or AAA. Chances are, one of them will fit your budget without cutting corners on protection.